What Can Be Deducted As Repairs On Schedule E

Tabular array Of Contents

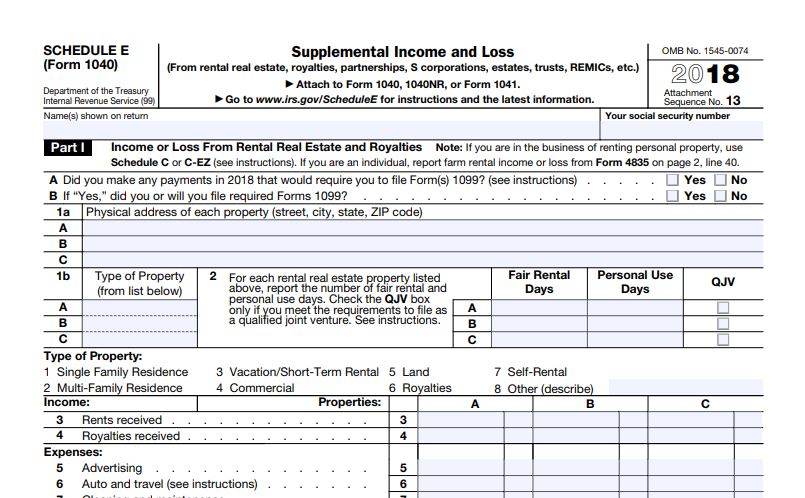

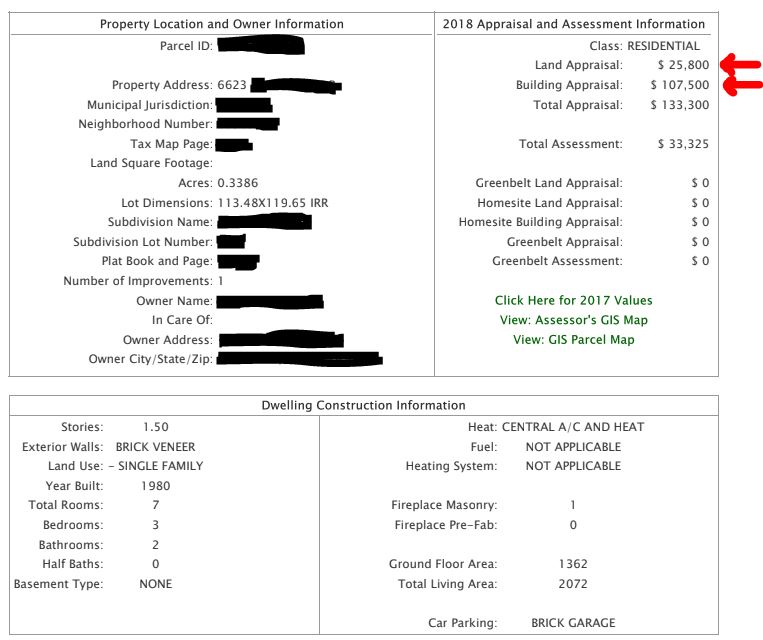

Whether you're a brand new investor trying to do it yourself or you have a million dollar portfolio and have a team of professionals, it's always a good idea to have foundational knowledge of each aspect of your business organization. I developed this comprehensive guide to allow real estate investors on every level meliorate empathize IRS Schedule E. While real estate tax can be complex, this guide is written for investors of all skill levels. I could have made information technology cumbersome and technical, just then my audition would be other CPAs which isn't the intent of this article, much less The Real Estate CPA™ equally a whole. Let'south begin by highlighting all the smashing cognition you'll walk away with subsequently y'all get through this commodity: To become the most out of this mail, information technology volition be helpful to download a copy of the IRS Schedule E and its instructions here. Hopefully the combination of IRS Schedule E, its instructions, and this awesome post will make it clear as mean solar day; that is, if you think taxes tin can e'er actually be "clear." IRS Schedule E is the grade where you will study "supplemental income and loss" related to rental existent manor, royalties, estates, trusts, partnerships, and S-Corporations. Emphasis on the fact that we are reporting "supplemental income and loss" and not "earned income." Think of earned income as business organisation income. Earned income is generated from an active trade or business. You lot pay self-employment tax on earned income. Real estate, royalties, partnerships, and Southward-Corporations can all generate earned income. For example, you may run a existent estate business where you are flipping or developing properties where y'all'd be required to study your income on IRS Schedule C; the schedule in which yous report earned income. Or you may be an possessor in a partnership or S-Corporation and have a combination of earned income and supplemental income. In this case, ane business can be reported on both IRS Schedule C and Due east. IRS Schedule E is used for supplemental income which is generally considered passive income. As an investor, this is of import because rental existent estate generates passive income and, as such, nosotros will written report the income and loss from rental existent estate on Schedule E. When you report income or loss on Schedule E, that income or loss is "re-routed" to unlike areas within your tax render. Your total taxable income or loss is reported on line 26 of Schedule East. The first and most important place you will encounter the terminate outcome of IRS Schedule E announced is line eight of your IRS Form 1040. Here you should see the full amount of net income or loss from your rental properties. If your activities on IRS Schedule E created a loss and your loss is not showing up on line 8 of IRS Form 1040, y'all may be limited past the Passive Action Loss limitations. While the Passive Activity Loss limitations demand an entirely separate post on their own, here's a high level overview: Many investors get worried when they hear this. They've been told real estate is a beautiful way to shelter income from taxes only now they are beingness barred from taking the well-deserved losses. What happens to the losses if you cannot claim them? They are called "unallowed losses" and are reported on IRS Form 8582. This class serves as a catchall that will keep track of all the losses y'all have non been able to claim over the years. Y'all do not "lose" these losses; they are only carried frontward until they can offset net rental income. These losses tin too be used to commencement the gain if yous were to sell a rental property, regardless of whether or not the rental belongings you are selling generated the specific loss. If the losses go carried frontward and y'all can't use them, doesn't that defeat the purpose of sheltering income from taxes? This is where I have to tell you that you've been gurued. Real estate is indeed an excellent way to legally avoid tax, but for high-income earners, y'all will only exist fugitive tax on the rental income, non your regular income from your job. Again, some amount of income or loss from your rentals should appear on line 8 of your IRS Form 1040. If your adjusted gross income is over $150,000, so you lot should await for IRS Form 8582 and see if the rental loss has been carried over to information technology. I of the almost important parts about preparing IRS Schedule E is making certain that we are accurately calculating the rental property price basis. The almost common advice is that the rental property basis is the buy price plus improvements. So if you purchase a property for $100,000 and add $ten,000 in improvements, the holding basis is $110,000. This communication, while correct, tin be misleading. If you are unaware that you must allocate a portion of the purchase price to land, you will calculate the incorrect depreciable basis and therefore deduct an wrong amount of depreciation. Information technology's important to understand how to determine the value of the land of a purchased property. In most cases, the easiest way to get this value is to pull the belongings'southward revenue enhancement card from the county assessor'south role. Doing then volition provide us with a "country ratio" which nosotros will then apply to the purchase toll. For instance, if the property tax card says that the land is worth $10,000 and the improvements are worth $40,000, then our country ratio is 20% [$10,000/($x,000 + $40,000)]. We would then apply this ratio to the purchase price of the holding to decide how much value we allocate to land and how much we allocate to improvements. See a sample property tax carte beneath: Why is this of import? Considering nosotros tin only depreciate the value of improvements since state is non-depreciable. State is everlasting and does non deteriorate. A too common mistake I see is depreciating the entire purchase price of the property. This is not correct bookkeeping and will demand to exist corrected via alternative methods. Don't make this error! Okay, now that we know we can't depreciate the state value of the edifice, let's figure out how to summate the property ground. The first matter that I do when preparing IRS Schedule Due east is a closing price analysis. I take developed a reckoner that helps me quickly summate a property's footing. The Closing Cost and Depreciation Calculator is an excellent tool to use when computing a rental holding'southward basis because information technology analyzes all sorts of closing costs such as title transfer fees, banking concern fees, loan origination fees, escrow, and seller credits. It then places them into the appropriate buckets which we'll hash out beneath, and calculates depreciation and amortization for the first year and on an almanac ground. I recommend using a tool, calculator, or guide to assistance you with the assay of your endmost costs and depreciation because you are going to be lumping costs into 3 distinct categories: The offset category, the belongings footing, consists of the agreed upon buy toll, plus closing costs like championship insurance, transfer taxes, inspections, appraisals (if paid outside of closing), travel costs, attorney fees, and notary or bank fees. From the property basis, we'll subtract out our land value to determine the total value in which nosotros will begin depreciating. This is called the depreciable ground. Purchase Price + Closing Costs – Land Value = Depreciable Ground Depreciation will commonly be over a period of 27.5 years. If you are investing in commercial property, you're looking at a 39 year period. Related: How to Calculate Rental Property Depreciation Expense At that place are several depreciation methods and conventions. Nosotros will be using the Modified Accelerated Cost Recovery Organisation (MACRS) for our depreciation purposes. While information technology sounds like a mouthful, all you need to know is that when you starting time identify a belongings into service (i.eastward. advertise it for hire), you will be granted a half calendar month of depreciation. And so, during the first year, you'll calculate depreciation on a monthly basis. So if I purchase a property and advertise it for rent on September 29, for the first twelvemonth I'll accept iii.5 months of depreciation (1/2 September + October + November + December). If my annual depreciation is $1,200, I outset divide that value past 12 to get it on a monthly basis, then multiply it by 3.5 to figure my offset year of depreciation. In our case, it will be $350. The second category is the loan price basis which is the sum of all costs associated with the loan. These tin exist the origination fee, credit report, bank fees, and appraisal fees if one was required by the lender. One time we summate the loan toll basis, nosotros will need to determine our annual amortization. Amortization essentially ways the same matter every bit depreciation, it's just the depreciation method for "intangible" costs. You lot will amortize your loan costs over the life of the loan. So if you take a xv-year loan, your amortization menses is 15 years. If you have a thirty-yr loan, your amortization period is 30 years. Permit's assume our loan price basis is calculated to be $3,000 and we accept a 30-year loan. Each yr, you will write-off amortization expense of $100 ($3,000/30 years). The starting time year of acquittal is calculated much like depreciation in that yous will be granted a half month for the month you place the property into service and and so amortize on a monthly basis until the end of the year. The third category is currently deductible expenses which consist of run a risk insurance, belongings taxes (not transfer taxes), and other miscellaneous expenses. These expenses do not need to be amortized or depreciated (whew!) merely are just deducted in full the start year. Find a Time Finally, what you lot've all been waiting for! Before we begin, click this link to open a copy of IRS Schedule E and so that you tin can follow forth. For the do it yourself investors, this section will be your taxation training bible. For all of my clients and everyone who already has a CPA, utilise this department to cross-bank check the CPA's work. The first section is seemingly the easiest but trips enough of folks upwards. Beginning, we have to decide whether or non we made any payments that required a 1099. Equally a general rule, you must issue a 1099 to contractors whom yous've paid over $600 for work during the yr. Starting in 2022, if your rental activities rise to the level of a trade or business (see an in-depth discussion here), yous will demand to issue 1099s to vendors. So if you are a landlord with rentals qualifying for the IRS Sec 199A deduction, tick the "yes" box when asked if y'all made payments that require a 1099. Otherwise, tick "no." Next nosotros'll enter the holding accost and the type of holding (single family unit, multifamily, etc). Hopefully this doesn't require much more than explanation. Now we need to determine fair rental days, personal utilize days, and whether or not nosotros are operating a qualified joint venture. For fair rental days, put the number of days the holding was actually rented and producing income. This is especially important if you accept rented the property for 14 days or less as then your rental income won't demand to be reported. Personal apply days must besides be inputted and can sometimes be confusing. You will only input personal employ days if yous have used the entire building for personal purposes, or anyone in your family has used the unabridged building for personal purposes. And so, if you are house hacking (living in one unit and renting out the others), you will not written report any personal use days. Instead, you will just split common expenses (mortgage, insurance, property taxes) between IRS Schedule A and E. A qualified joint venture most often occurs when two spouses own a holding 50/50 and do non live in a customs property country (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin). If the spouses of a jointly endemic rental live in a community belongings state, at that place is no need to worry near, or elect, the qualified articulation venture condition. When rental belongings is jointly owned past spouses who are not located in a community property state, nosotros have a trouble. The spouses must either report their income and losses on a partnership taxation render (complicated!) or elect the qualified joint venture status. Per the IRS Schedule E instructions: "If you and your spouse each materially participate as the merely members of a jointly endemic and operated rental real manor business and you file a articulation return for the tax yr, you can elect to exist treated as a qualified joint venture instead of a partnership." When you and your spouse jointly own an entity that owns your rental property, information technology can get complicated fast. That discussion is across the scope of this post, but you will need to speak with a CPA to sort everything out. Next we are going to written report the rental income received. This is going to be all gross income received from your tenants throughout the yr. Gross rental income should include: rental income, refunds received for utilities, and pro-rated rents when you lot purchased the property. Expenses are where the tax abstention (legally) comes into play. I wrote a quick blurb on what to written report per expense item: Advertizement – include all general marketing and advertising costs. These can include the cost to identify rent signs in the front yard, to annunciate on certain websites or publications, to buy business organization cards, and to send mailers. Auto and Travel – include all ordinary and necessary auto (to exist discussed later) and travel costs required to maintain your rentals. This should non include auto and travel costs incurred to purchase your starting time rental or to expand your rental business organisation into a new geographic location. Too include 50% travel meals. Cleaning and Maintenance – include all cleaning expenses to prepare a unit for a tenant or once a tenant moves out. Include maid expenses here as applicable. You should also include maintenance expenses such every bit painting, mowing, and small budget costs of the edifice, appliances, and equipment. Commissions – include realtor or property management commissions paid to find a tenant for your unit. Insurance – include homeowners, run a risk, and inundation insurance here. Do not pro-charge per unit your almanac insurance. You will but written report the amount of insurance that you actually pay to your insurance company, not the amount that you pay into escrow. **A note about escrow – it'due south very common to pay insurance and property taxes into escrow on a monthly ground. This protects the lender from your failure to pay these expenses. It's important to understand that when yous pay these expenses into the lender'due south escrow account, this is not a deductible expense for you. It is only deductible once the lender actually pays those expenses to the county/city or the insurance agent. That'southward when you lot can deduct the expenses. Why? Paying into escrow is essentially moving money from pocket A to pocket B. It's still your money and technically an nugget on your residuum sail. Legal and Professional Fees – include expenses related to attorney fees, bookkeeping, and costs of concern/financial planning related to your rentals. Management Fees – include the cost to hire an amanuensis or property manager to manage your rental. This may also include special service calls that the property director incurs to bank check on the rental. Mortgage Interest Paid to Banks – include the corporeality of interest reported to you by the bank on Class 1098. This corporeality will be the entire interest the bank has received from you during the yr, including the interest you paid during endmost. Other Interest – include the amount of involvement paid to tertiary parties, whether they are private investors, private businesses, crowdfunding platforms, or relatives. Too make certain that y'all take sent these people or parties a Form 1099 showing the involvement you have paid them. Without a Form 1099 in this instance, you may not be able to substantiate the deduction. Repairs – include all repairs made to the property that were not considered capital improvements. Expenses here volition be small repairs and not the replacement of floors, roofing, etc. Yous may also include De Minimis Safe Harbor expenses here if they are less than $2,500 and you brand the annual election. Supplies – include the price of incidental materials and supplies such as newspaper for printing, minor tools, and other minor miscellaneous materials that don't fit into some other category. Taxes – include all tax expenses incurred as a result of owning and operating the rental property. This tin include property taxes, schoolhouse commune taxes, and special easements or land taxes. Do not include income taxes. Utilities – include utility expenses that you take personally incurred, even if the tenant has reimbursed you for them. Practice non include utility expenses that the tenant has paid for without you ever having to pay for it. The reason we include utility expenses here even if the tenant has reimbursed yous for them is that we are reporting the reimbursement every bit income at the acme of IRS Schedule E and we want to offset that income with the expense yous incurred. Depreciation Expense – include the depreciation expenses that you calculated. Depreciation is an imperative part of IRS Schedule Eastward; don't mess it upwards! Other (list) – include all other expenses incurred while operating the rental just that did not directly fit into any of the categories to a higher place. Examples of these expenses may include bank fees, education, HOA fees, subscriptions, price of books, De Minimis Safe Harbor (if not reported in repairs), meals and entertainment, and gifts to clients or tenants. You lot will itemize each of your "other" expenses on a split page. Once we have all of the expenses inputted into our IRS Schedule E, we add them upwards and decrease them from our gross rental income. The income or loss for each belongings volition exist reported on line 21; if line 21 is a loss, line 22 will show you how much of the loss you can really deduct. Line 24 will testify you the total internet income each property has produced if each property showed internet income. If the property instead showed a loss, and y'all are able to have that loss, y'all will meet the amount on line 25. Recollect, your losses may be limited due to the Passive Activity Loss rules. All of that data will exist reported on Form 8582 then definitely review that class if you are showing rental losses. Line 26 of IRS Schedule Eastward will show the full income or loss that will be reported on line 8 of our Form 1040. Merely before nosotros calculate line 26, nosotros demand to look at Role ii of IRS Schedule East to study any partnership or Due south-Corporation income and losses. Partnerships and South-Corporations volition provide yous with an IRS Schedule 1000-1 at the finish of the twelvemonth. That information volition be reported on Part 2 of IRS Schedule Eastward. Basically, nosotros are reporting the proper name of the partnership, whether information technology's a partnership or an S-Corporation, whether it's foreign-owned, and what the employer identification number (EIN) is. We volition then desire to report the passive income and non-passive income received from the partnership or S-Corporation. This information will come up straight from IRS Schedule K-one that the partnership or Southward-Corporation provides you. Entities must go through the same blazon of reporting we are doing hither with IRS Schedule E. While they apply different forms, they are reporting the aforementioned information and and then providing that information on a summarized form – IRS Schedule Chiliad-i. If you lot have not received IRS Schedule K-one simply yous accept an buying stake in a partnership or an S-Corporation, you have a couple of options. The easiest matter to practise is file an extension and wait to file your returns until you really receive the IRS Schedule K-i. The other option is to go alee and file your returns, so file an amended return once you receive IRS Schedule K-1. Okay, that wraps up IRS Schedule E for the most office. Whatever appears on line 26 will also appear on line 8 of your Form 1040. Make certain that menstruum is happening correctly to avert issues. You'll use IRS Class 4562 (link here) to report your auto expenses and merits those beautiful IRS deductions. First thing starting time, if information technology isn't documented, y'all tin can't have the deduction. Document everything! Related: The Existent Estate CPA Podcast, Episode #one - Documentation: The Fundamental to Taxation Savings Next, the question is what should we be documenting? That's a bang-up question and it depends on your overall strategy. Many revenue enhancement advisors recommend using the "bodily expense" method in which you tape all of your motorcar expenses incurred throughout the twelvemonth and deduct the portion allocable to the business concern use. Even so, information technology'due south important to have a good idea of payoff vs. effort. Recording and documenting actual car expenses can take a considerable amount of effort. Sometimes, the additional deduction the actual expense method will grant you over the "standard mileage" method simply isn't worth your fourth dimension. I know, you're probably shocked that a CPA is recommending leaving money on the table. I'one thousand just trying to be realistic. CPAs want to relieve you every penny possible without regard to the time it takes yous to put all of this information together. They do this because they tin can show you how much more you saved past working with them so they tin charge y'all a higher rate. But if information technology takes you an additional 10 hours throughout the year to document an additional $500 in deductible business expenses, your revenue enhancement savings will be your marginal charge per unit multiplied by that $500. So if you're in the 25% bracket, yous're additional 10 hours of piece of work has saved you $125. Congratulations, yous've paid yourself an hourly wage of $12.50. Now, a $12.50 hourly wage is improve than many people, but yous are a real estate investor. You lot have a business organisation to run. Your hourly wage should exist over $100. Related: Tax Write Offs for Automobile Business Expenses And so what'south my bespeak? Spend some time estimating your annual deduction using both the standard mileage rate and the actual expense method. Decide, up front, which method volition probable yield college results. The standard mileage method is bully considering is very easy to runway and takes no fourth dimension at all thanks to groovy smart telephone apps similar MileIQ. At the end of the year, you'll compile all of your motorcar expense documentation and report it on page ii, Function V of IRS Form 4562. The total expense will and so flow to IRS Schedule E every bit an Auto Expense. If you stuck with me through that entire commodity, give yourself a huge pat on the back. You now have the fundamental cognition required to await at an IRS Schedule E and sympathise what is going on. Nosotros talked about what IRS Schedule Due east is and how it interacts with the rest of your return. On a loftier level, we went over what costs go into your rental property cost basis and what y'all need to do to calculate depreciation (meet our Cost Basis and Depreciation Computer here). We walked through IRS Schedule E and each expense line item and even talked virtually car expenses. If y'all're hungry for more than or looking for a deeper dive, check out the manufactures referenced throughout this postal service. If you want to know more well-nigh something, contact united states of america at contact @ therealestatecpa.com and throw in a proffer for a topic. I'd dearest to hear from you lot! Drop us a line today for a free quote! Fill Out a Webform

What IRS Schedule E is Used For

How IRS Schedule Eastward Interacts With the Residue of your Return

The last point is very important to understand. If your adjusted gross income is higher up $150,000, you cannot claim your passive losses confronting your other income unless you are a real estate professional.Wait, What? I tin't Deduct my Passive Losses?

Determining Belongings Basis and Depreciation

The Belongings Basis

The Loan Toll Ground

Currently Deductible Expenses

Join us at a Virtual Workshop to get your taxation questions answered live by our CPAs!

Reporting Rental Holding on IRS Schedule Eastward

Income and Expenses to Report on IRS Schedule East

Calculation it All Upward

Reporting Car Expenses and What You lot Need to Know

Putting information technology All Together

If that was as well complicated, permit us take your taxes off your hands.

Source: https://www.therealestatecpa.com/blog/ultimate-guide-irs-schedule-e

Posted by: smithflemen.blogspot.com

0 Response to "What Can Be Deducted As Repairs On Schedule E"

Post a Comment